Chapter

04

Competitive Analysis: What are other schools doing?

The following chart looks how hybrid is currently being delivered and discussed amongst our competitors.

| FTE EnrLL | Offering Nomenclature | Website Description & Titles | M.Div. In-Person Req. | 100% Online | |

|

SMU Perkins School of Theology |

198 |

Hybrid Houston-Galveston Extension Program |

"Hybrid" |

15-18 trips |

No |

|

Duke Divinity |

566 |

Hybrid M.Div. |

"Hybrid Online Degrees and Certificates" |

9 trips |

No |

|

Candler School of Theology |

334 |

Hybrid M.Div. |

"Hybrid/Online" |

5 trips |

No |

|

Asbury Theological Seminary |

1156 |

Modalities: Residential, Hybrid, Online |

"Hybrid" |

18-24 (or 1-2 / course) |

Yes |

|

St. Paul School of Theology |

64 |

FLEX: Flexible Learning EXperience |

"Online & Hybrid Classes" |

6-9 trips |

No |

|

Iliff School of Theology |

111 |

Journey |

"Combination of Hybrid and Online" |

9 trips |

Yes |

|

United Theological Seminary |

307 |

Online Seminary Degree* *indicates being designed for SEO |

"Online Seminary Degree Options" "Online Options" |

2 trips |

No |

|

Garrett-Evangelical Theological Seminary |

196 |

Hybrid |

"Hybrid Master's Degrees" |

5 trips |

No |

|

SMU Perkins School of Theology |

--- |

Formats: Residential, Extension, Hybrid |

"Hybrid" SEO will use "online" language. |

4-6 trips |

No |

Table Analysis

Most notable from the table is how the language is being used. For the most popular programs with the strongest enrollment, the title of 'hybrid' is nearly universal. These hybrid programs are all defined by being a majority online with a few trips to their respective campuses or extension sites. For the programs with the strongest enrollment, the distance-learning of the degrees allow them to use "online" language, however, they do so as part of their website and message, not to define their format.

Pulling this list together also emphasizes the confusion facing prospective students. When their only "hybrid" option at Perkins is HGEP, it is easy to see why they are asking for something, "more online." Our modality shift means that we are now accurately able to market our offerings as hybrid. The marketplace has shifted rapidly in the last few years and the HGEP does not compete for the same audience that it once did, shedding light on why the program has been limited in its capacity to reach beyond the Greater Houston area.

By simply lowering the number of required trips to campus, we become a more competitive option than ever before.

For Perkins, we really have two competitor sets:

Identity Competitors

_______

Duke Divinity School

Candler School of Theology

Direct Competitors

- Paul School of Theology

- Garret Evangelical Theological Seminary

- United Theological Seminary

- Iliff School of Theology

- Claremont School of Theology

Identity vs Direct

Identity Competitors are those schools which most evidently share a similar identity with SMU Perkins. They are embedded institutions with similar buildings, histories, faculty, affiliations, and missions. It is easy to look at these schools and reasonably assume that our target audience should overlap with that of Candler or Duke. Yet, when looking at class sizes alone, it is evident that we are much more aligned with our Direct Competitors.

Our "Target Audience," therefore, may overlap with our Identity Competitors but will not be the focus of our marketing and recruiting campaigns.

Target Audience

Instead of expending energies on competing with Duke, we will focus efforts on our direct competition: St. Paul, Iliff, Garrett, and Claremont. To that end, the hybrid format that Perkins has developed will have the most immediate impact in that it offers more flexibility when comparing hybrid programs than our direct competition. At 18 trips for a degree, a student may well choose St. Paul over the Houston-Galveston Extension Program. By simply evening the number of trips for in-person (not to mention including the difference immersions make), we are able to stake our established brand name with SMU, our historic precedent in the church, our impressive alumni network, and our financial assistance offerings over and against whatever our direct competitors are offering.

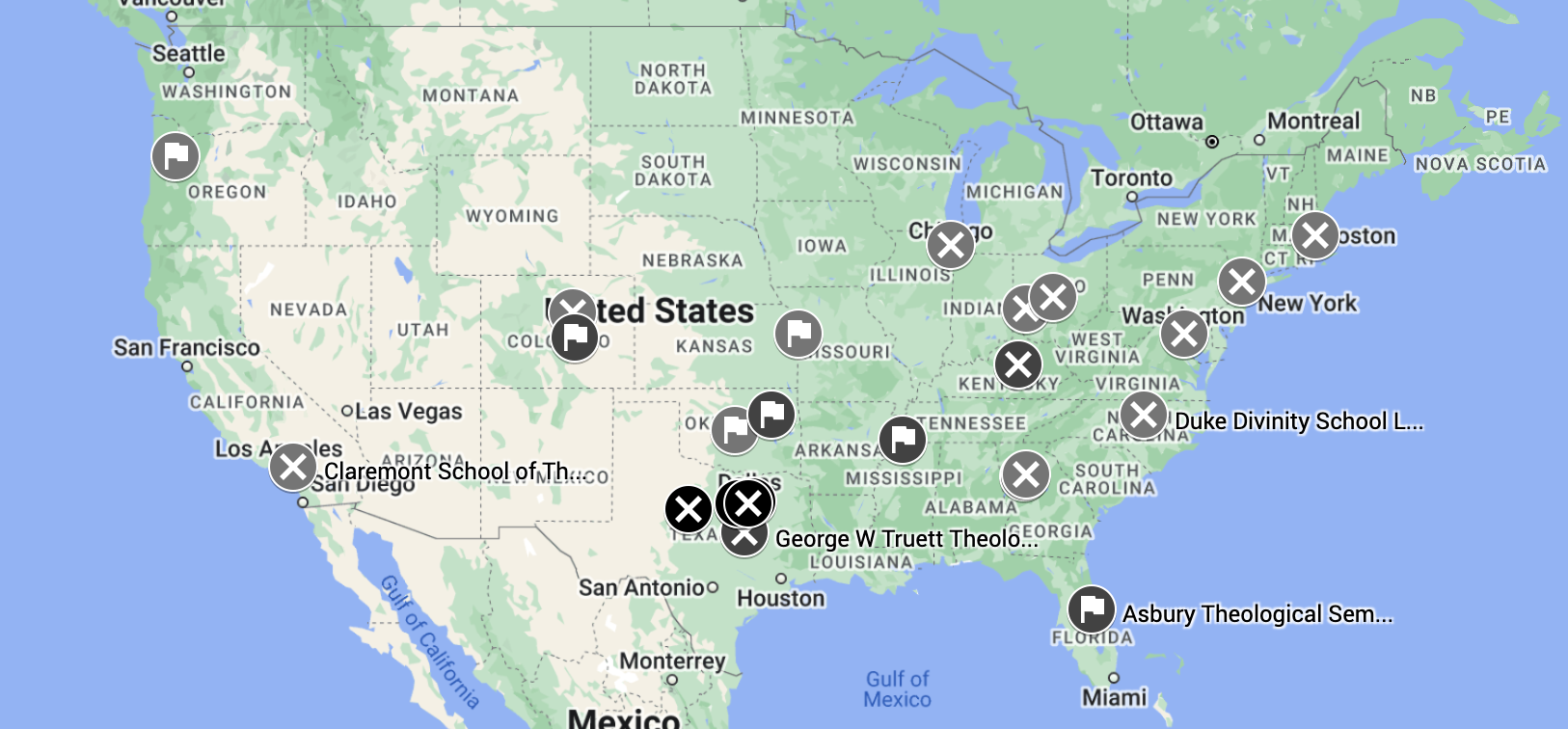

By going after both our regional and our FTE-equivalent competition, we stand a much greater chance of increasing enrollment. Regionally, as outlined by seminary distribution the map below, it is clear that there is a window of opportunity for Perkins to expand most directly to the North (from Arkansas up and through Iowa) and to the West (Denver, New Mexico, and Seattle).